Early stage due diligence is the systematic process investors use to validate a startup's potential before committing capital. It's not just about checking boxes—it's about building conviction, uncovering risks, and establishing a foundation for partnership.

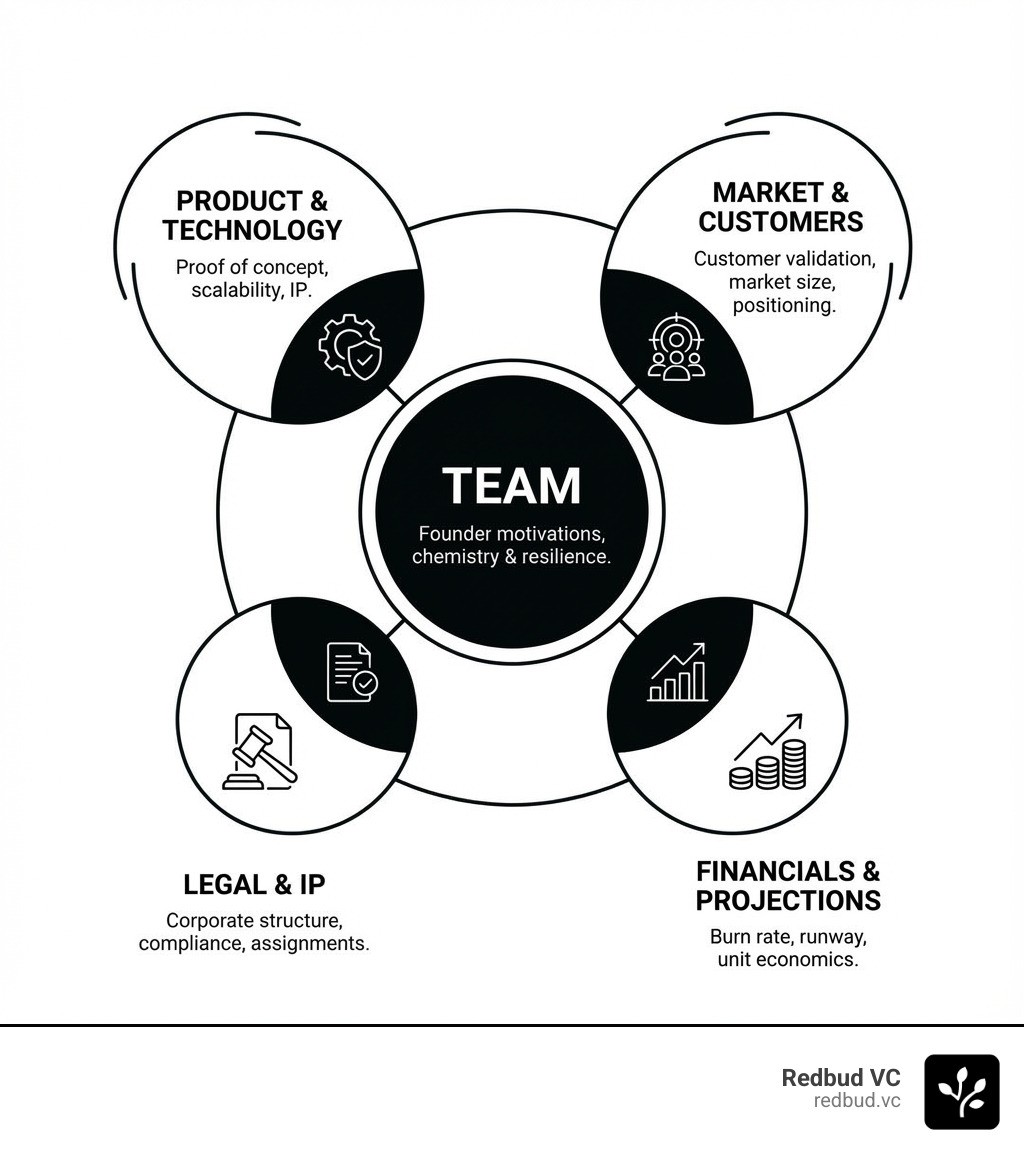

What early stage due diligence covers:

The Team - Founder backgrounds, motivations, chemistry, and resilience

Product/Technology - Proof of concept, scalability, and IP protection

Market Opportunity - Customer validation, market size, and competitive positioning

Financials - Burn rate, runway, unit economics, and funding strategy

Legal Foundation - Corporate structure, IP assignments, and regulatory compliance

In startup investing, enthusiasm can outpace caution. What most founders miss is that due diligence isn't a hurdle to clear—it's your opportunity to prove your story with facts.

At the seed stage, most startups have little traction or revenue. They have a pitch deck, an idea, and a founding team. Investors at this point are betting on the founders' ability to steer chaos and build something the market wants. The most important diligence, therefore, is on the team itself—their motivations, resilience, and alignment.

Early-stage diligence is about confirming the initial signals that sparked interest, whether it's strong user love, organic growth, or a founder's unique insight, and verifying that those signals are real and repeatable.

Companies with ongoing investor relationships before fundraising can often complete due diligence in two to four weeks. A cold pitch may take longer, but hopefully less than six weeks.

I'm Brett Calhoun, Managing General Partner at Redbud VC, where I've led early stage due diligence across dozens of investments. Before venture, I spent years conducting financial diligence for companies of all sizes, giving me a practitioner's view of what separates signal from noise.

The Shift in Focus: Why Early Stage Due Diligence is Different

Early stage due diligence isn't a watered-down version of later-stage scrutiny; it's a fundamentally different process. Later-stage investors evaluate established companies with years of financial records and proven business models. They scrutinize a well-oiled machine for predictable growth.

At the pre-seed and seed stages, however, the landscape is undefined. Most startups have little traction or revenue. This scarcity of hard data shifts our focus from the business to the people. We are "betting on the ability of two or three individuals to steer chaos and emerge with something the market wants." This is why diligence on the team itself—their motivations, resilience, and alignment—is paramount.

Our approach must be fast, focused, and right-sized. We skip exhaustive, Series A-style data requests that overwhelm founders. Instead, we zero in on validating the few strong signals that caught our attention, like passionate user love or a founder's unique insight. This human-centric process is about assessing vision and resilience. Our thesis at Redbud VC is built on backing founders with Struggle Not Pedigree: Outsider DNA Builds Unicorns, recognizing that true grit often comes from overcoming adversity.

The Core Pillars of Early Stage Due Diligence

This section breaks down the key areas investors scrutinize, starting with the most critical element at this stage—the team.

The Team: Betting on Founder Resilience and Dynamics

At the heart of every early-stage investment is the team. As we've learned, "You are backing people before product, especially early." Our early stage due diligence goes beyond résumés to dig into:

Founder Background and Experience: We look for relevant domain expertise and execution track records, but prioritize passion and practical experience over pedigree.

Motivation and Vision: We ask: Why this? A compelling vision tied to their personal journey is a powerful indicator of resilience.

Team Chemistry and Dynamics: We observe co-founder interactions, looking for complementary skills, strong communication, and mutual respect. For founders seeking their perfect match, our guide on How to Find a Co-Founder for a Tech Startup offers valuable insights.

Coachability and Adaptability: We assess their openness to feedback and willingness to pivot based on market signals.

Reference Checks: We conduct back-channel reference checks to gauge how founders handle pressure. The best founders welcome this scrutiny.

Leadership Assessment: We look for leaders who can attract talent and build a strong culture. While "only about one third of VC backed companies still have a founder CEO at IPO," initial leadership sets the foundation.

Founder-Market Fit: We look for deep market understanding, often from lived experience, which provides a significant advantage.

"Research shows founder evaluation is critical" because we're investing in individuals with the resilience to steer the startup journey.

Product & Technology: Assessing Viability and Scalability

Next, we focus on the product and technology to understand the venture's potential and defensibility.

Proof of Concept (PoC) and MVP Stage: We look for tangible evidence the idea works, like a functional prototype or an MVP with early users. A "Seed Stage: Product/technology proof of concept" is the starting point.

Technology Stack and Scalability: We assess if the tech stack is appropriate for future growth and can scale without costs rising in lockstep.

Intellectual Property (IP) Ownership and Strategy: IP is a critical barrier to entry. We verify the company owns its IP and that all employees have signed invention assignment agreements. "Copies of the Intellectual Property and Invention Agreements signed by key employees and consultants" are vital.

Product Roadmap and User Feedback Loops: A clear product roadmap informed by user feedback shows foresight. We want to see how they validate customer need and plan to iterate.

Barriers to Entry: Beyond IP, we look for other moats like network effects, data advantages, or unique distribution channels.

Our investment in Hallway is a prime example of our belief in strong product and technology. Read more about Why We Invested in Hallway to see these factors in practice.

Market & Customers: Validating the Opportunity

A great team and product need a viable market. This pillar validates the problem, solution, and adoption potential.

Market Size (TAM, SAM, SOM): We analyze TAM, SAM, and SOM to ensure the market is large enough for venture returns, verifying pitch deck claims with third-party sources. "Market size is assessed using TAM, SAM, and SOM."

Customer Problem and Validation: We look for evidence of a real, acute customer pain point, often through "initial market research and validation" and direct customer conversations.

Early Traction and Customer Interviews: "Early-stage diligence is about confirming the few signals that sparked your interest, whether it’s strong user love, organic growth, or a founder’s unique insight." We conduct customer interviews for impartial, "on-the-ground validation" of the product.

Competitive Landscape: We analyze direct and indirect competitors, the startup's unique value proposition, and how the competitive landscape might evolve.

Go-to-Market (GTM) Strategy: We evaluate the clarity and scalability of the GTM strategy, including distribution channels, sales, and marketing.

Market Timing: Timing is crucial. For instance, "AI startups highlight market timing importance" as "AI startups accounted for 45% of all new unicorns in 2024," showing the shift toward AI.

Financials & Projections: Making Sense of Pre-Revenue Numbers

Evaluating early-stage financials is more art than science. We look for financial discipline and future potential, as companies are often pre-revenue or have up to "$1M in annual revenue."

Burn Rate and Runway: We analyze the monthly burn rate and runway to understand future funding needs. Founders must "Articulate burn rate, runway, hiring plans, and revenue assumptions with clarity and consistency."

Financial Projections and Key Assumptions: We scrutinize projections for realism and logical assumptions, focusing on near-term milestones. Overly optimistic projections are a red flag.

Unit Economics (CAC, LTV): Founders need a clear hypothesis for Customer Acquisition Cost (CAC) and Lifetime Value (LTV). These metrics are critical for proving a scalable business model, and "Founders might be asked tough questions about unit economics and scalability."

Cap Table Structure: A clean cap table is essential. We review the "Cap Table (Pro Forma)" to understand ownership and dilution. A messy cap table can be a "ticking time bomb" for future funding.

Funding Strategy: A clear, long-term funding strategy tied to specific milestones demonstrates strategic thinking.

Our investment in Banking Solution Clearing Secures Pre-Seed Funding highlights our commitment to companies with solid financial foundations.

Legal & IP: Building a Clean Foundation for Growth

Legal and IP diligence forms the company's bedrock. Overlooking it can cause significant future problems.

Corporate Formation and Governance: We ensure the company is properly incorporated with all "Corporate formation documents" in order.

IP Agreements and Ownership: For tech startups, we verify all IP is legally assigned to the company. "Copies of the Intellectual Property and Invention Agreements signed by key employees and consultants" are vital.

Founder Vesting: We confirm founder equity is subject to vesting schedules to ensure long-term commitment. "Ensure all team members have equity vesting."

Regulatory Compliance: We assess industry-specific regulatory compliance (e.g., fintech, health tech) and ensure the company understands its obligations.

Key Contracts: We review material contracts for unusual terms, liabilities, or dependencies.

Potential Litigation: We assess any disclosed legal disputes for their potential business impact.

Data Privacy and Security: We examine data management and security practices for compliance with regulations like GDPR and CCPA.

For founders navigating early funding, understanding the legal landscape is key. Our guide, A Founder's Compass: Successfully Navigating Term Sheet Negotiations with VCs, provides essential insights.

A Founder's Playbook: How to Prepare and Win at Due Diligence

This section offers founders actionable advice for a smooth due diligence process. View early stage due diligence not as an interrogation, but as a chance to showcase your transparency and business acumen.

Your Data Room Checklist for early stage due diligence

A well-organized data room signals professionalism and speeds up diligence. "Good data, timely and efficiently gathered, will never hurt." Here's an essential checklist:

Pitch Deck & Executive Summary: Your current investor presentation.

Business Plan: A detailed overview of your strategy, market, and operations.

Product Documentation: Roadmap, technical specs, demo videos, and user feedback.

Customer Data: Sales pipeline, contracts, churn rates, engagement metrics, and reference contacts.

Team Information: Founder bios, org chart, offer letters, and vesting schedules.

Cap Table (Pro Forma): A detailed breakdown of all equity holders (including SAFEs and notes).

Financials: Historical statements, projections with assumptions, burn rate, runway, and unit economics.

Corporate Documents: Articles of Incorporation, Bylaws, and board/shareholder minutes.

Intellectual Property (IP) Documents: List of patents, trademarks, and all IP assignment agreements.

Legal & Regulatory: Key contracts, terms of service, privacy policy, and compliance records.

Go-to-Market (GTM) Plan: Detailed strategy for customer acquisition.

Competitive Analysis: Your understanding of the market landscape.

A secure, well-structured data room not only streamlines the process but also builds investor confidence.

Common Red Flags and Founder Mistakes to Avoid

Certain red flags can derail an investment. Founders should be aware of these to address them proactively.

Inconsistent Storytelling: Ensure your story, numbers, and vision are cohesive across all investor conversations.

Unrealistic Projections: Overly optimistic forecasts without defensible assumptions are a red flag. "Overly optimistic projections contribute to nearly 30% of startup failures."

Reluctance to Share Information: Delaying access to data erodes trust. Be transparent.

Unclear Use of Funds: Lacking a precise plan for the use of funds or awareness of your burn rate and runway.

Messy Cap Table: A complex or overly diluted cap table, especially with non-standard terms, signals future problems.

Founder Conflicts or High Turnover: Co-founder disagreements or high team churn indicate instability. "65% of startup failures can be attributed to team issues."

Poor References: Negative feedback from past employers, mentors, or early customers.

Lack of Transparency: Not disclosing known challenges is a major red flag. We value founders who are honest about problems and have mitigation plans. "Proactively disclose potential issues rather than having investors find them independently."

Early stage due diligence is also "an opportunity for a startup to improve"—a "free consultation" to identify and fix internal issues.

The Investor's Perspective: Balancing Speed, Thoroughness, and Thesis

For investors, early stage due diligence is a balance of thoroughness and speed. We know opportunities are time-sensitive and founders have limited resources.

Investor Thesis and Thesis-Driven Diligence: Our investment thesis guides our diligence, helping us "know where to dig deep and what to skip." For Redbud VC, this means focusing on founders with discerning resilience in tech.

Process Timelines: The process "typically takes 4-8 weeks," but we strive for efficiency. With a pre-existing relationship, it can be "two to four weeks"; otherwise, "less than six weeks." We aim to be "fast, focused, and right-sized."

Balancing Speed and Thoroughness: Our goal is to understand risks and build conviction, not eliminate risk entirely. We adapt the extensive diligence process, which can take "roughly 118 hours and 10 references across 83 days," for the early stage.

External Experts: We leverage external experts (domain specialists, legal counsel) for deeper insights, helping us make informed decisions without overburdening the startup.

Deal Memo: Our internal deal memo is a critical tool that documents our process, findings, and risks. As one source puts it, "A great deal memo isn't just a summary—it's proof of thought."

Building Conviction: "Diligence is how conviction is built." It's the process of confirming claims and uncovering red flags before committing capital.

Frequently Asked Questions about Early Stage Due Diligence

How long does early stage due diligence typically take?

The timeline for early stage due diligence typically ranges from 2 to 6 weeks, depending on factors like founder responsiveness and deal complexity. As noted, "Companies that have ongoing conversations with potential venture capital investors... typically can get through due diligence in two to four weeks." For a "cold pitch," it usually takes "less than six weeks."

Light diligence for small checks may take 1-2 weeks, while typical seed rounds are 3-4 weeks. Complex deals can take 5-6 weeks or more.

What is the single most important area of focus in early stage due diligence?

The single most important focus is the founding team. As research shows, "The most important diligence at this stage is on the team itself."

At this stage, with minimal traction or revenue, investors are "betting on people before product, especially early," because "execution risk is highest early on." We look for:

Resilience: The capacity to handle pressure and adapt.

Adaptability: The willingness to learn and pivot.

Vision: A clear understanding of the problem and solution.

Alignment: How well co-founders work together.

A strong team can overcome flaws, while a weak one can derail a great idea. This is why "Why VCs back people before product" is a core investing principle.

Can a startup fail due diligence and still get funded?

Yes, sometimes. It depends on the nature of the issue and the founder's response.

Red Flags vs. Yellow Flags: Not all issues are deal-breakers. We see "yellow (repairable)" flags, which are fixable, and "red (distrust)" flags, which often point to fundamental problems.

Fixable Issues: If issues are fixable, founders can address them. "Due diligence is an opportunity for a startup to improve," and we value founders who treat it that way.

Building Trust and Transparency: A founder's reaction is key. Transparency and a credible plan to fix issues build trust. Defensiveness or hiding information can terminate a deal.

Re-engaging Investors: Addressing concerns and showing progress can lead to re-engagement with investors, even if a deal doesn't close immediately.

Conclusion: Due Diligence as a Partnership Catalyst

At Redbud VC, we see early stage due diligence not as a barrier, but as a catalyst for a strong partnership. It's an immersive process that benefits both sides.

For founders, it's a "free consultation"—a rigorous review that helps identify blind spots, strengthen foundations, and refine your narrative. It provides clarity and helps build a more robust business.

For us, it's about building conviction beyond the pitch deck. It's how we understand your team, your vision, and your potential for discerning resilience. This process fosters trust and forms the bedrock of our collaboration, ensuring we invest in a shared future, not just an idea.

We are committed to backing resilient founders who are building the next generation of tech companies, from Columbia, Missouri, to Kansas City, the broader Midwest, New York City, Miami, and Toronto. We believe that thorough early stage due diligence is the secret weapon that transforms promising startups into sustainable growth stories.

Join our community of resilient founders and savvy investors and let's build something remarkable together.