In a “stay-private-longer” era, the ability to cash out early is a decisive advantage for the nimble early-stage VC model.

TLDR:

Smaller funds benefit from early-stage entry at lower valuations with smaller holdings, enabling greater upside and faster liquidity through secondaries — e.g., Redbud VC had a material exit in two years, selling to a Series A investor.

Valuation increases and allocation competitiveness at later rounds have increased the appetite for downstream investors to buy stock from early investors

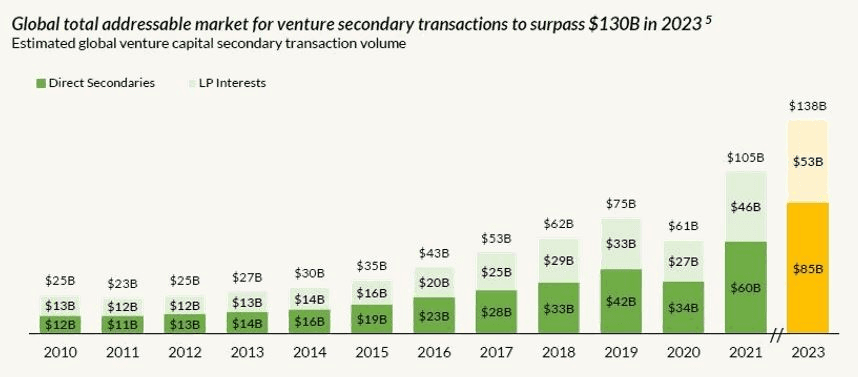

Secondary equity markets have surged, with volumes reaching $94.9B in Q3, aiding nimble VCs in achieving early DPI amid prolonged private stays.

Large/mega funds have struggled to reach distributions due to surges in round sizes, valuations, and time-to-public.

While mega funds attract most capital for stability, nimble funds’ agility and alignment may offer better cash returns for LPs, despite higher risks.

Research suggests nimble VC funds (sub-$50M) often deliver higher returns/liquidity than large or mega funds, with median IRRs around 13–20% vs. 2–10%.

Discipline Wins

From the outside looking in, the venture capital industry appears to be a below-average asset class with subpar risk-adjusted returns. Those who are poking around on Google or ChatGPT are likely to surface results that paint a glum picture — no liquidity and average returns. One of the main drivers for the drop in performance is due to the zero-rate era, when everyone was a tourist in VC and valuations and round sizes skyrocketed. Many emerging and late-stage funds lost the right to raise a subsequent fund. This has driven a consolidation of LP capital into mega funds that may have lower return expectations and liquidity pressures from their LP base. As capital is consolidated, these funds have to deploy more capital into fewer companies, pushing them to move earlier and earlier.

As mega funds move upstream, they can outprice nimble early-stage funds because they’re betting on early-stage venture as an option to lead late-stage rounds where they can write large checks. This can create headwinds — two to highlight are i) founders will struggle to exit due to inflated valuations with a dense liquidity preference, and ii) large rounds with higher valuations influence the market’s perception of market valuations. The market rewards co-investing with tier 1 logos and quick markups, which are not always correlated with investing in good businesses. This can have headwinds for early-stage venture funds, but the fund managers who stay disciplined will reap the benefits — this is not an opinion on valuations for each deal, but instead on a portfolio-construction level, as there are opportunities where it makes sense to invest at valuations well above market medians.

Nimble Funds Advantage

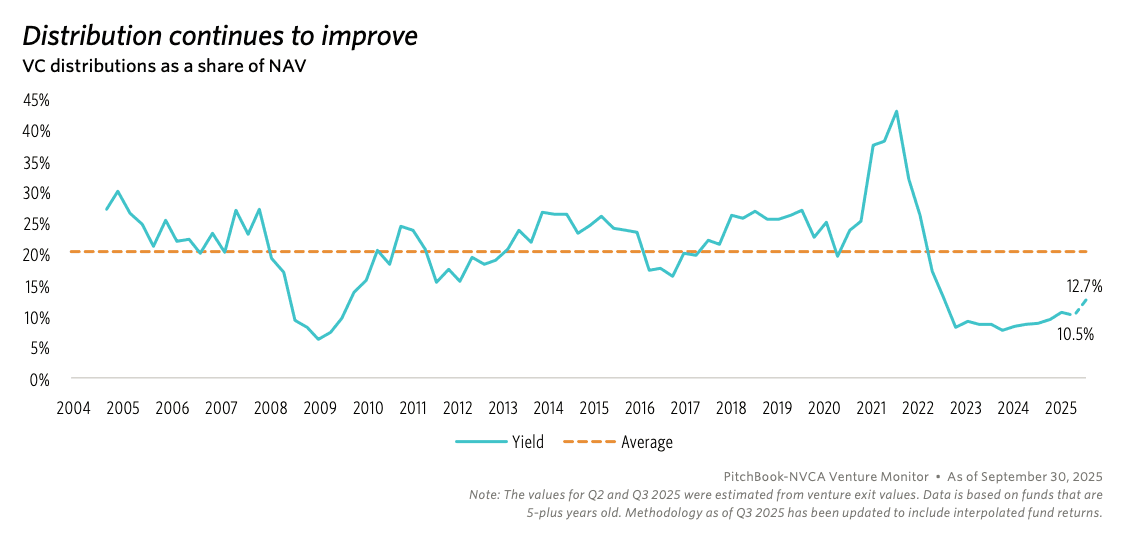

In 2023, at Redbud VC, we invested $100,000 into a pre-seed company at a reasonable valuation. Just over two years later, we sold 25% of that position for $1.05 million as part of a Series A, with a quarter of the Series A used to buy out existing investors. That single partial exit returned 21% of our fund I, a 42x return, and a 500% IRR. Although a relatively small transaction, this is an example of the prevailing sentiment and events unfolding in the broader market. There is significant buzz around the venture capital industry’s lack of distribution in the last few years. Although these concerns are valid, they are primarily driven by mega (billions) or large (multi-hundred-million) fund sizes, overshadowing the liquidity of small ($100M) or nimble (sub-$50M) VC funds from booming secondary markets and downstream investor buyouts. Below, you can see distributions have plummeted, but the market is experiencing a slight uptick.

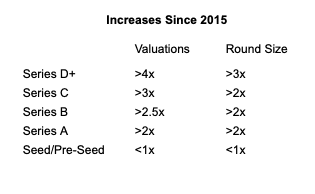

Nimble VCs are structurally positioned to outperform across internal rate of return (IRR), total value to paid in capital (TVPI), and distributions to paid in capital (DPI). Their advantages stem from early entry, flexible ownership sizing, and the ability to exit in smaller, more digestible chunks without disrupting the cap table or sending negative signals. Downstream investors struggle to hit their ownership targets, so they are buying out early investors as part of the round and, in some cases, receive discounts to the round price. Limited partners are likewise growing frustrated with the industry’s dearth of actual cash distributions. In 2023, venture fund payouts plunged to their lowest level in nearly 14 years, leaving many LPs hesitant to re‑up with managers who haven’t returned much cash. In this era, the earlier liquidity pathways of nimble VCs (like secondaries) become even more compelling as companies are staying private longer (up 30% in the last decade) or are raising significantly more capital at much higher valuations, narrowing the window for acquisitions. The increase in valuations has also outpaced round sizes, reducing ownership levels for later-stage funds and increasing early-stage investors’ appetite for buyouts. Below, you can see that the delta between valuations and round sizes increases at a later stage, creating an ownership mismatch for funds.

(Pitchbook NVCA Monitor Q3 2025)

Booming Secondaries

Another tailwind is the booming secondary market, ballooning to over $100B in annual volume globally, with the U.S. slice hitting $41.8–59.9B in 2024 alone. Median deal sizes topped $64M in 2025, exploding from $10M in 2024. This is huge for early-stage stockholders as most secondaries will involve a bundle of VCs, founders, angels, and employees. For nimble early funds with smaller holdings, jumping into these setups is a smart way to generate DPI without stirring up cap table drama. Later-stage buyers often need to hit 10–15% ownership thresholds and are happy to scoop up shares from early backers, creating natural liquidity windows. Elite early-stage firms now commonly trim 10–30% of positions in pre-IPO rounds, balancing realized gains with ongoing potential.

Early Fund Gets the Cash

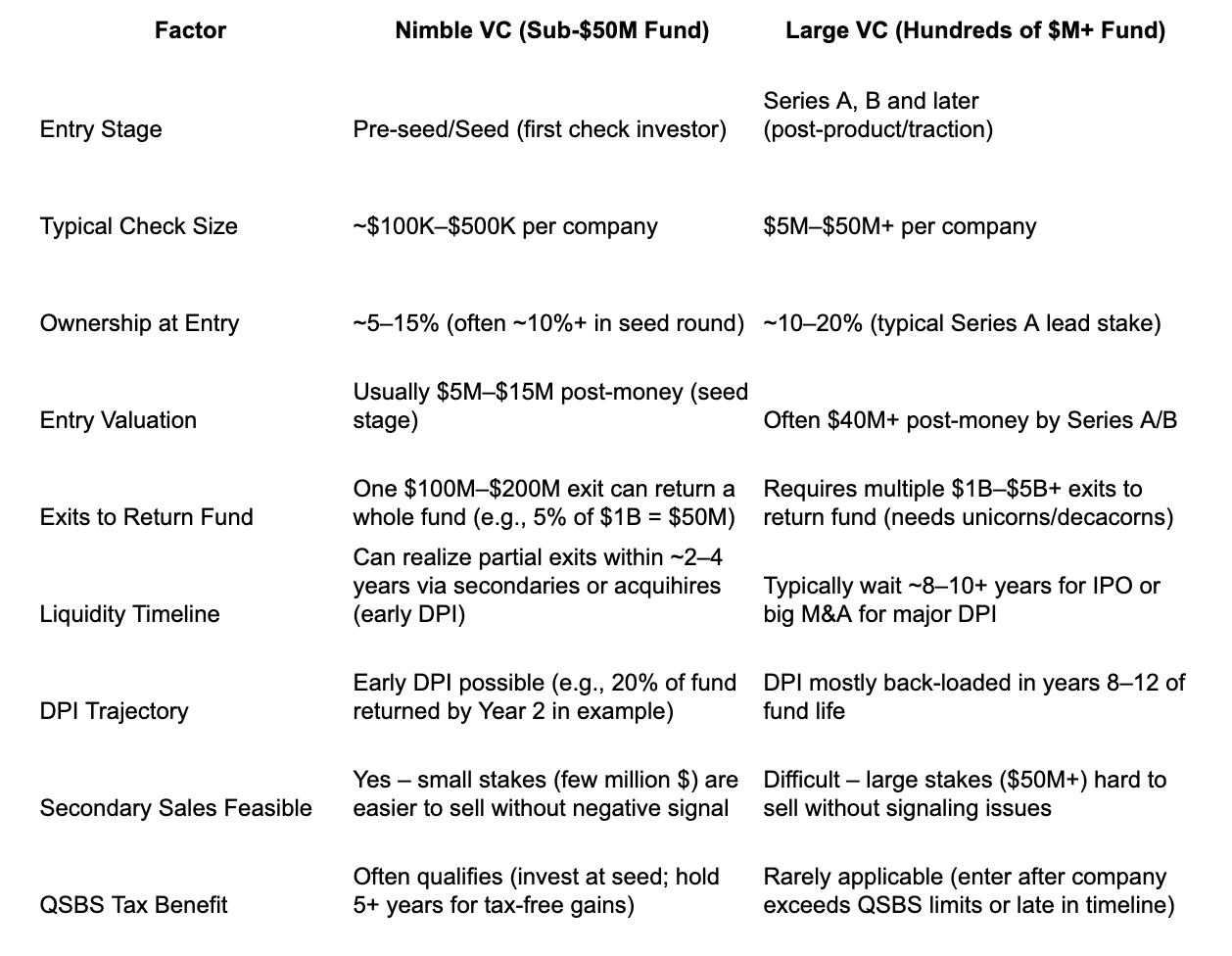

Nimble VCs benefit from investing at the earliest stages, where entry prices are lowest, and upside potential is highest. By writing pre-seed or seed checks, these funds buy meaningful ownership in startups for pennies on the dollar compared to later investors. A $500k investment at Pre-Seed may yield the same ownership as a $5M check at the Series A.

Getting in on the ground floor at a tenth of the price sets the stage for enormous multiples if the startup scales. Since Seed valuations have historically been a fraction of Series A valuations, there’s often a steep jump in valuation between rounds. Early VC investors lock in that pre-jump price, giving them a built-in pricing advantage that later-stage funds simply don’t have.

Small stakes also mean smoother sales overall — a seed fund’s few-percent ownership might balloon to $50M on a 100x mark, easy to parcel out in $5–10M chunks to eager buyers like secondary funds or downstream investors. By contrast, a growth fund’s $200M position (from a $5M check at 40×) is more challenging to move without raising eyebrows, founder pushback, or ROFR hurdles. From a tax angle, nimble VCs frequently qualify for QSBS perks, allowing tax-free gains after a 3+ year hold — something later entrants often miss as companies outgrow eligibility. Nuances of nimble and large VCs below:

In this “stay-private-longer” era, the knack for engineering early cashouts gives nimble early VCs a clear leg up, decreasing the traditional venture timeline and delivering real value to LPs sooner.

Bigger Isn’t Always Better

It’s not just a new trend; historical data show that nimble funds (under $50M) tend to deliver more substantial relative returns than larger players. A study spanning decades indicates that sub-$350M funds have a 50% higher chance of achieving 2.5x returns than mega-funds above $750M. Carta’s look at U.S. funds from 2017–2019 backs this up, with the tiniest ones ($1M–$10M) delivering superior median IRRs — for example, 13.8% versus 9.8% for $100M+ in 2017 — and TVPIs (2.0x vs. 1.6x), a trend that carried through the following years. Remind you, this data was in the earlier innings of the secondary markets and prior to the increased appetite of late-stage VCs buying out early-stage VCs.

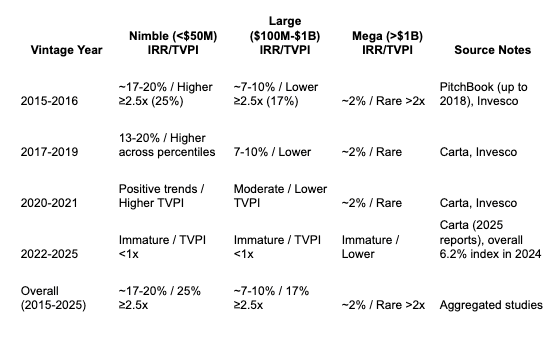

Diving deeper, the table below captures performance across vintages, showing nimble VCs leading in IRRs and TVPIs over large ($100M–$1B) and mega (over $1B) funds:

From the numbers, nimble VCs clock in at 17–20% IRRs overall, with 25% achieving TVPIs of 2.5x or better — well ahead of large funds (7–10% IRRs, 17% at that level) and megas (~2% IRRs, seldom topping 2x).

The reason boils down to basic math: it’s simpler to multiply returns on a modest base. A couple of standout investments can triple a $25M fund’s value, while a mega-fund requires a series of massive exits — like multiple billion-dollar companies — to even approach solid averages.

With so few blockbuster exits available — only around 3% of global VC-backed deals topped $1B in 2024 — it’s a tall order. Most liquidity comes from sub-unicorn acquisitions or smaller IPOs, which fuel nimble funds just fine but barely register for mega funds. A $150M buyout could 4x a small fund’s stake; for a multi-billion outfit, it’s negligible. This pushes large funds to chase massive exits every time, sometimes at the expense of smarter plays. Now, larger funds do have a more focused portfolio with less diversification, but the pros and cons of that are a conversation for the future.

Take the common push to scale companies toward an IPO, even when a solid $200M offer is staring them in the face. Founders often share tales of big VC backers nixing mid-sized exits to “go for unicorn gold.” A real-world twist: 7BC Venture Capital passed on a $50M raise at $200M valuation, opting instead for $10M at $40M pre-money (around $50M post). That setup needed only a $200M exit for 4x returns — a realistic acquisition path — and they landed a $225M offer. But if a mega-fund had joined at the higher valuation, they’d likely veto the sale, insisting on a $100M+ round for IPO dreams, stretching timelines, and risking flops. Nimble funds’ agility to lock in those “modest” wins (by big standards) benefits everyone — funds, LPs, and founders.

Late Stage Squeeze

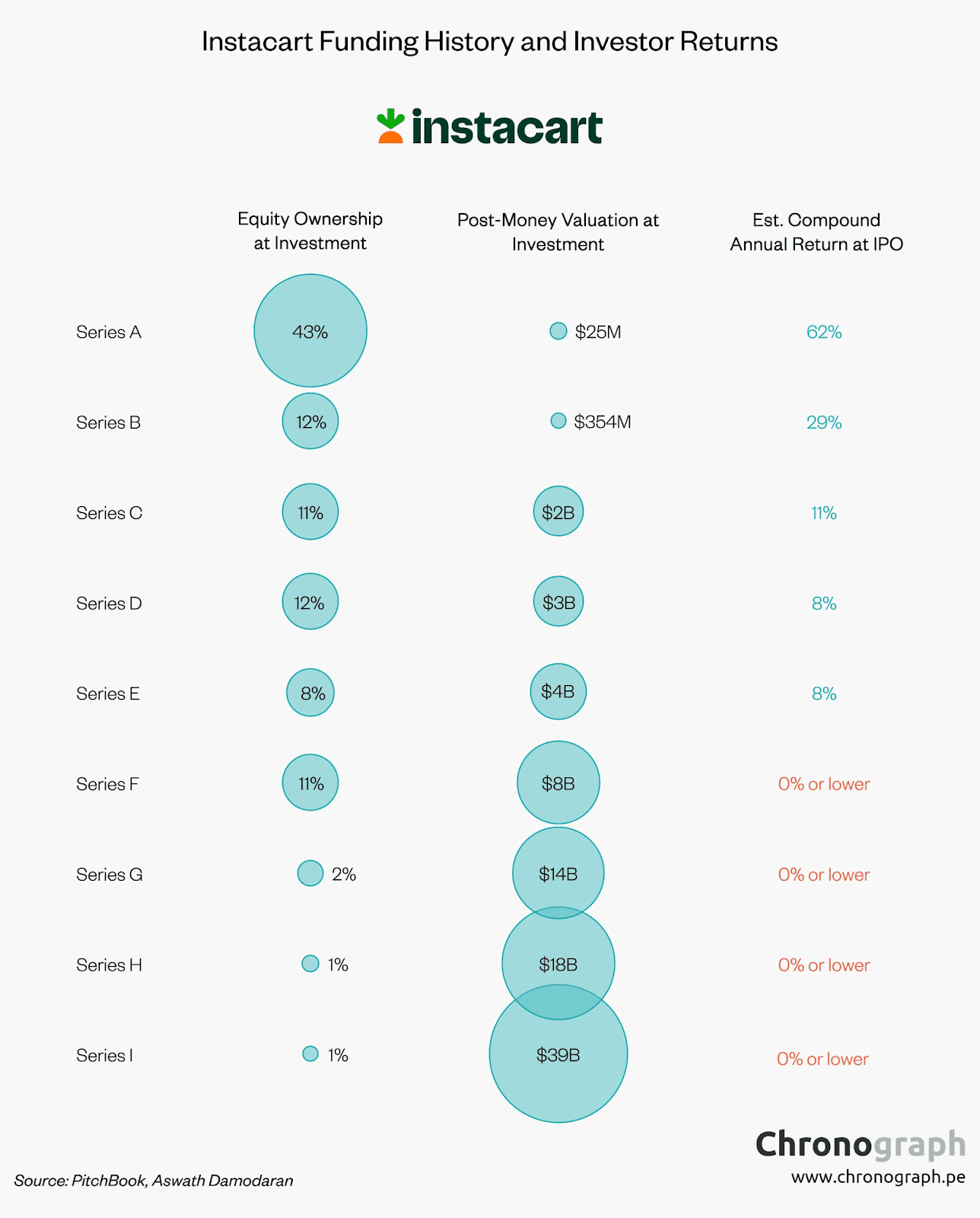

Then there’s the late-stage squeeze: mega-funds skip tiny seed bets for Series A/B/C deals where $5–50M checks fit, but by then, valuations are 20–100x seed levels, squeezing multiples. They’re battling a pack of growth investors for scarce prizes, further inflating prices. Look at Instacart’s 2023 IPO: late-stage backers from Series F on took losses after peak private buys, while Series D/E folks scraped minimal gains, and early seed investors cashed in big. It’s a classic reminder that entering cheap and early often trumps the “de-risked” premium of later rounds. In VC, size shapes strategy, and nimbleness of smaller funds produces outsized results.

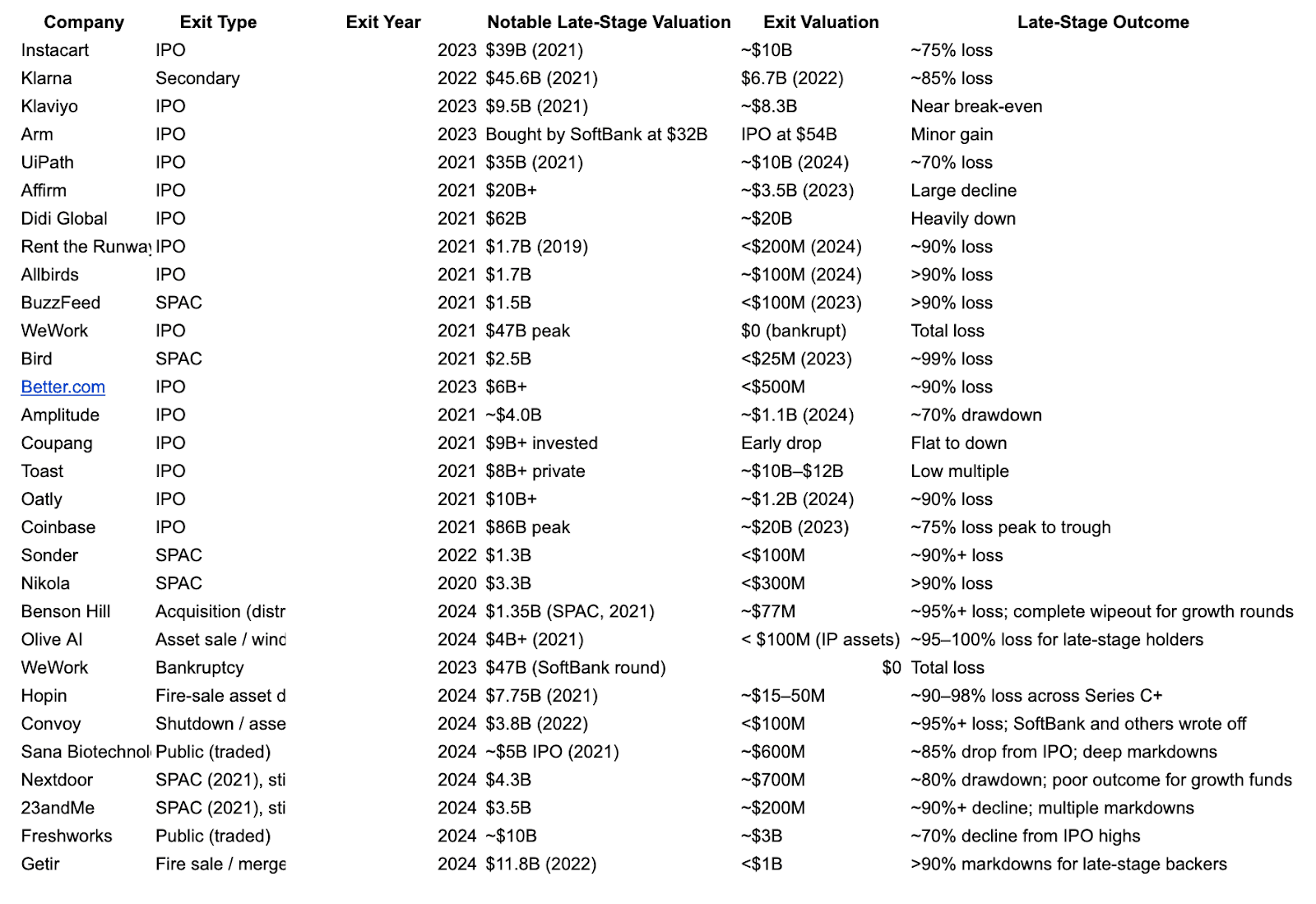

That said, Instacart is not alone. Many companies that went public or were acquired later lost investors’ money.

(Redbud VC internal research)

Getting on the cap table earlier in bite sizes can yield outsized multiples on invested capital, but more importantly, distributions or, hence, real returns. Not to mention, the potential for a 30% increase if the gains are tax-free as QSBS. There is a liquid future for VC; LPs just need to invest in nimble early-stage funds.

Originally posted: https://redbud.beehiiv.com/p/liquid-future-nimble-vcs-have-a-liquidity-advantage